A state's unexpected emergency proclamation that inhabitants should shelter in place for a specified period of time, except for crucial personnel;

Promoters might not inform taxpayers that they should minimize wage deductions claimed on their own small business' federal earnings tax return by the level of the Employee Retention Credit. This will cause a domino impact of tax problems for that enterprise.

A4. No. It is best to pay back the quantity because of or Get in touch with the IRS utilizing the Get hold of info on the recognize for payment choices or collection solutions.

What happens when an ERC refund is been given? In early December 2024, IRS Commissioner, Danny Werfel, declared the IRS could be ramping up the approval of ERC claims. Related statements are already built up to now (like in summer season 2024), nevertheless the IRS fell short then and It isn't totally obvious no matter whether just about anything will transform now, Though We've seen some uptick in ERC refunds. Having said that, it seems not likely that all the believed 1.four million promises might be processed in the next handful of months.

A3. You do not qualify for that ERC in the event you did not function a business or tax-exempt Group with employees.

An purchase from a local health Office mandating a office closure for cleaning and disinfecting.

Establishing modern pricing structures and alternate price arrangement versions that deliver additional value for our shoppers.

Then mail it to your deal with in the Recommendations for your altered return that applies to your business or Group. This may choose lengthier for that IRS to obtain your ask for. Track your deal to confirm shipping.

The in depth assessment through the moratorium allowed the IRS to move into this new stage of the program with much more payments and disallowances. In addition, the IRS will remain in shut connection with the tax Skilled Neighborhood to help navigate in the advanced landscape.

Some examples of taxpayers who are not qualified to assert the ERC and are frequently qualified by ERC scam promoters include things like:

While the ERC is now not available, organizations might be able to assert the credit retroactively.

Mail the new adjusted return on the IRS utilizing the handle in the Directions for the form that applies to your online business or Group. Never deliver the new adjusted return to your focused ERC assert withdraw fax line. IRS will likely not process new adjusted returns despatched to this fax line.

In this employer’s manual, we’ll define what the Employee Retention Credit is, how to understand if your enterprise qualifies, and Together with the deadlines now extended into 2024 and 2025, we’ll protect how one can use.

Use this tutorial To find out more about practical experience ranking, the way it impacts employer insurance plan rates, and methods for controlling here these bills.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Matilda Ledger Then & Now!

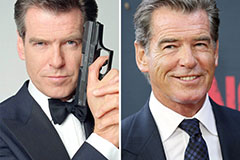

Matilda Ledger Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!